Managing company finances has never been more complex for Israeli and global startups expanding into international markets. Each country adds layers of currency, regulation, and reporting. AI changes the game: not just as a technical add-on, but as a strategic lever that empowers finance leaders and CFOs to run global financial strategy more safely and intelligently.

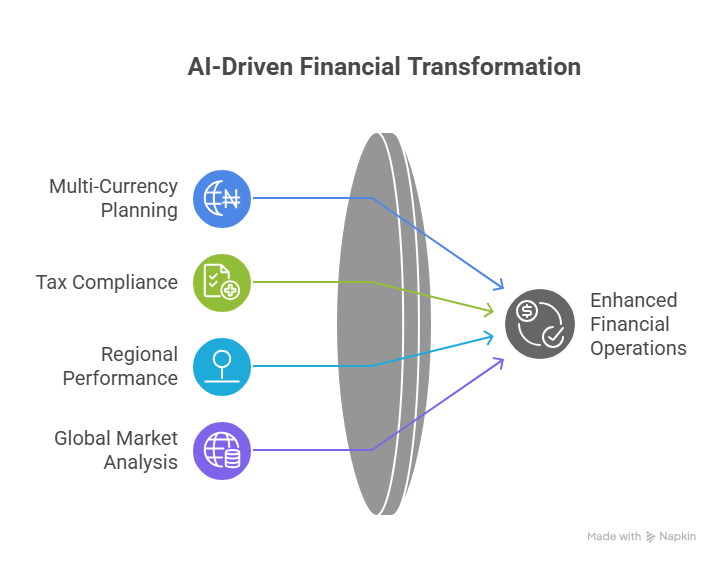

This article explains how AI supports multi-currency cash-flow planning, cross-border tax compliance, regional performance control, and global market analysis and management reporting. It also shows how the CFO’s role is evolving from tactical controller to strategic global leader and how AI enables the shift from local thinking to global decision-making through forecasting, scenario planning, and proactive opportunity/risk detection.

How AI Improves Your Financial Operations

Multi-Currency Cash-Flow Planning

Operating across countries means dealing with multiple currencies and exchange-rate volatility. AI models can forecast currency movements, recommend optimal conversion timing, and even trigger automated hedging when needed. The result: reduced FX exposure and steadier global cash flows.

Compliance With Local Tax Regimes

Every jurisdiction has its own tax rules. Tracking them manually is cumbersome and risky. AI-enabled systems update themselves as regulations change and apply those updates directly to your financial workflows: aligning reporting with local requirements, calculating indirect and corporate taxes by country, and suggesting optimal treaty positions to reduce overall tax burden. Compliance improves, penalties are avoided, and finance teams spend less time on manual checks.

Regional Performance Control

As you scale, visibility by region is essential. AI-driven analytics provide a live view of core metrics by market – revenue quality, unit economics, pipeline health, and contribution margins – so the CFO can spot variances early and intervene where it matters.

Global Market Analysis & Management Reporting

Strategic expansion demands deep insights. AI can process massive, heterogeneous datasets – from macroeconomic indicators to local consumer signals – to surface opportunities and risks by market. It might flag rising demand in one geography or shifting behaviour in another and propose data-backed responses. At the same time, AI auto-generates standardized global management reports, consolidating multi-country data into one consistent view for resource allocation, investment priority, and global initiative planning.

The New CFO: From Tactical to Strategic Global Leader

In the modern digital era, the CFO’s job goes far beyond closing the books and producing historical reports. AI automates and accelerates tasks that once consumed hours – multi-entity consolidation, bank reconciliations, granular budget control – freeing the CFO to lead strategy.

Armed with robust forecasting and analytical tools, today’s CFO becomes the organization’s financial compass: directing capital allocation, anticipating emerging risks, and recommending moves that maximize global growth. It’s a paradigm shift – from “financial gatekeeper” focused on stability and operations to strategic leader who connects business vision with optimal financial execution across regions.

From Local Thinking to Global Decision-Making

One of AI’s most profound impacts is mental: enabling teams to think globally rather than locally. Reactive planning no longer suffices. AI is the catalyst for a proactive, worldwide view:

1) International Forecasting & Scenario Planning

Finance teams can model countless “what-if” scenarios across markets e.g., how an economic slowdown in Europe would affect North American cash flow, or how a sharp move in JPY would impact margins. These simulations, built on real-time and historical data, support contingency plans and agile playbooks before events unfold.

2) Opportunity & Risk Detection in Every Market

AI continuously scans vast data streams search trends, economic releases, local news, and social signals to spot patterns. It can highlight a fast-growing niche in an emerging market worth entering or warn about a regulatory shift or a local competitor gaining share. With near-real-time signals, the CFO knows when to press the accelerator and when to brake.

In short, AI expands the company’s financial field of view. Decisions rely on a comprehensive understanding of the global environment, not just local assumptions. Startups evolve from siloed regional operations to orchestrated global organizations leveraging cross-market synergies, preparing for cross-border risks, and capturing opportunities wherever they appear.

Bottom Line

AI is transforming how startups manage international finance. Capabilities once reserved for large enterprises accurate forecasting, real-time global monitoring, automated multi-currency and compliance workflows, and early opportunity discovery are now accessible to growing companies. For the modern CFO, AI is a strategic partner that enables swift, informed decisions based on a complete global picture not merely a tool for process efficiency.

About ERB

For over 30 years, ERB has provided comprehensive financial services to startups and Israeli companies operating globally. Our end-to-end offering supports startups from incorporation and financial infrastructure building through the ongoing management of accounting, tax, and operational finance.

Looking for a broader financial solution – CFO services, forecasting, scenario analysis, and opportunity mapping tailored to your startup? We’re here to help.