Table of Contents

Establishing an Israeli Entity: A Guide for Foreign Companies and Startups

Many international companies – from agile startups to established U.S. and UK firms – are looking to establish a presence in Israel. Israel’s reputation as the “Startup Nation” and its thriving tech ecosystem make it an attractive location for R&D centers and subsidiaries (over 400 multinational companies have already set up R&D centers in Israel).

If your company is interested in opening a company in Israel or creating an Israeli subsidiary, this guide will walk you through the key steps and explain how partnering with a financial services firm ERB can make the process smoother.

Why Expand to Israel?

Israel offers a dynamic innovation environment and talent pool. Major global tech firms and startups alike have a strong presence in Israel, leveraging its highly skilled workforce and innovative culture. There are hundreds of R&D and innovation centers of multinational companies operating in Israel, including those from the US and UK.

By establishing an Israeli entity, foreign companies can tap into this talent, participate in the vibrant local tech scene, and potentially benefit from government incentives for R&D and innovation. Moreover, Israel is known for being relatively business-friendly in terms of company formation, with straightforward incorporation procedures and flexible requirements. In fact, incorporating a company in Israel is often described as a simple and quick procedure, a new company can sometimes be registered in as little as 24–72 hours once all documents are properly submitted.

Tip: Before launching any operations, ensure that creating a formal legal entity is required. Even if you’re initially just hiring a few local contractors or opening a small sales office, significant business activity usually means you’ll need to register a local entity (either a branch or a subsidiary) to stay compliant.

Branch vs Subsidiary: Choosing the Right Structure

As a foreign company, you typically have two options for establishing a presence in Israel: setting up an Israeli-registered subsidiary or opening an Israeli branch of your foreign corporation. It’s important to understand the difference:

Israeli Subsidiary:

A subsidiary is a new Israeli company that is a separate legal entity owned by the foreign parent. This structure limits the parent company’s liability to its investment in the subsidiary (protecting the parent from direct liability for local debts).

Incorporating as a local company also offers flexibility for future growth (for example, bringing in local investors or selling the subsidiary in an exit).

In general, it is usually more beneficial – from a legal and operational standpoint – to incorporate a local subsidiary in Israel rather than operate through a branch.

Most foreign startups and multinationals opt for a subsidiary because of the clear separation and simplicity.

Branch of Foreign Company:

A branch is essentially an extension of your existing company in Israel, not a separate legal entity. The foreign company directly conducts business in Israel through the branch. While this can have some tax advantages (profits are taxed in Israel but remittances back to the parent may not trigger additional dividend taxes), it also means the foreign parent is directly liable for all obligations of the branch.

Setting up a branch involves registering the foreign company with the Israeli Companies Registrar and appointing a local representative for tax purposes.

In practice, establishing a branch tends to be more complex and slower than forming a new local company.

Banks may also impose stricter requirements or limited services for branches as compared to local companies.

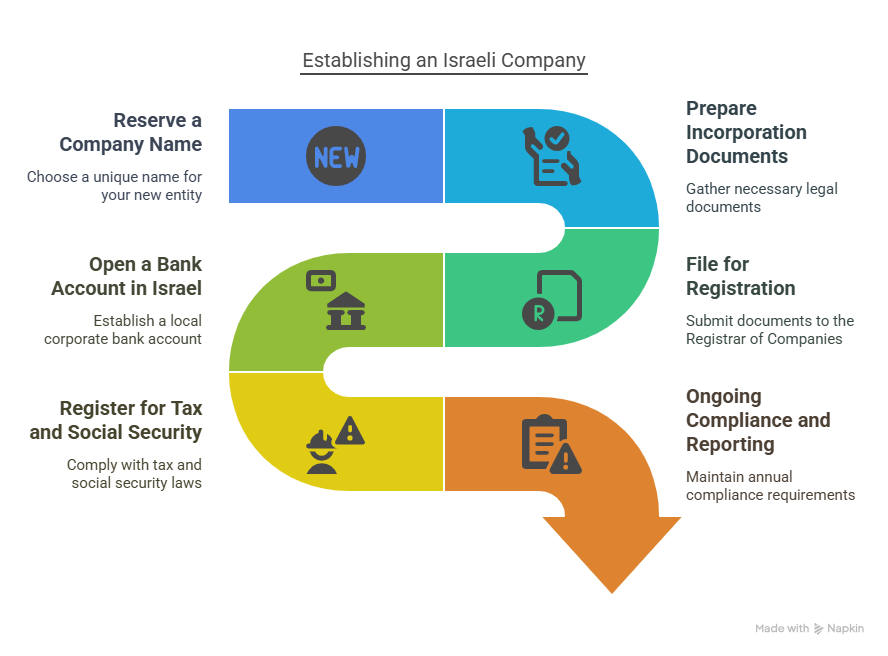

Steps to Establish an Israeli Company (Subsidiary)

Reserve a Company Name:

Choose a unique name for your new Israeli entity. The Companies Registrar requires submitting one or more proposed names (in order of preference) and will approve the first available name that is not already in use or too similar to existing companies.

Ensure the name is appropriate and meets any local naming rules.

Prepare Incorporation Documents:

Israeli company formation involves a few standard documents that need to be filed with the Registrar of Companies. These typically include:

Articles of Association – the company’s constitutional document outlining its structure and governance.

Initial Director and Shareholder Declarations – statements signed by the first directors and shareholders affirming they are eligible to hold these positions.

Copies of identification documents for all directors and shareholders.

Note: Israel allows 100% foreign ownership and directorship – you do not need an Israeli citizen as a director or shareholder. Even a single individual or foreign corporation can fully own and direct the company.

However, the IDs (passports for individuals, or incorporation certificates for corporate shareholders) must be notarized and accompanied by an apostille to be legally recognized in Israel.

This certification can typically be done via an Israeli embassy or local notary in your home country.

Registered Israeli Address:

Every Israeli company must have a local registered address in Israel to receive official correspondence.

This doesn’t need to be a physical office you rent – many foreign companies use the address of a local lawyer, service provider, or a virtual office. The key is that it’s a real street address in Israel (P.O. boxes are not accepted).

Tip: ERB and similar firms can often provide a registered address service for your company if needed, ensuring you don’t miss any important mail.

File for Registration:

Submit the signed documents to the Israeli Registrar of Companies and pay the required registration fee. As of recent updates, the government incorporation fee is around ₪2,412 ILS (approximately $640 USD), though this can change slightly year to year. Once the Registrar approves the application, they will issue a Certificate of Incorporation for your company, along with a company number and copies of the filed Articles and initial declarations.

At this point, your company is legally formed. The good news is that Israel’s Registrar is efficient – in many cases, the company can be registered within 1–3 business days after submitting all correct documents.

If documents are incomplete or incorrect, the Registrar may reject the application, causing delays-another reason to have local experts assist you in this process.)

Open a Bank Account in Israel:

With your new company established, you will need to open a local Israeli bank account under the company’s name. This is crucial, because you typically cannot register for taxes or conduct business transactions until a corporate bank account is in place.

Opening a bank account in Israel as a foreign-owned company can be one of the more challenging steps. Banks will require documentation such as the certificate of incorporation, company articles, resolutions from your board to open the account, identification of authorized signatories, and information on the business’s activities.

It’s common for the bank to request an in-person meeting with the company’s representatives as part of their due diligence.

Be prepared for stringent Know-Your-Customer (KYC) and compliance questions – Israeli banks, like those globally, have tightened regulations and will want to clearly understand the nature of your business and its owners. Tip: This is an area where a local financial services partner can be invaluable. Firms like ERB assist clients in navigating bank requirements and can liaise with banks to smooth the account opening process.

Register for Tax and Social Security:

After incorporation, an Israeli company must register with various tax authorities:

VAT (Value Added Tax): If your entity will be selling goods or services in Israel, you must open a VAT file. Israel’s standard VAT rate is currently 17%. Foreign-owned companies may need to appoint a local VAT representative in some cases (especially if operating as a foreign branch), but a subsidiary managed by local directors/officers can usually handle VAT registration directly.

Corporate Income Tax:

Register the company with the Income Tax Department to receive a tax ID and fulfill corporate tax reporting obligations (Israel’s corporate tax rate is 23% on profits.

National Insurance and Payroll Tax Withholding:

If you plan to hire employees in Israel, you must register as an employer with Bituach Leumi (National Insurance Institute) and the tax authority for withholding (payroll) tax. This enables you to remit the required social security and income tax deductions from salaries.

These registrations typically require filing forms and providing your company details and the local bank account info. A professional service provider can help complete these registrations quickly so you can commence operations in compliance with local laws from day one.

Ongoing Compliance and Reporting:

Once your Israeli entity is up and running, remember that maintaining it is an ongoing responsibility. Israeli companies have annual compliance requirements similar to those in other countries. For instance, you must file an Annual Return with the Registrar of Companies each year (detailing the current directors, shareholders, etc.) and pay an annual fee to keep the company in good standing.

Neglecting these can result in penalties – in fact, failing to submit annual reports for just two consecutive years can trigger heavy fines (sometimes on the order of $2,000 USD per penalty).

On the tax side, you’ll need to file periodic VAT reports (usually monthly or bi-monthly), periodic payroll tax reports, and annual financial statements and corporate tax returns. All these obligations underscore the importance of having reliable bookkeeping and accounting processes in place.

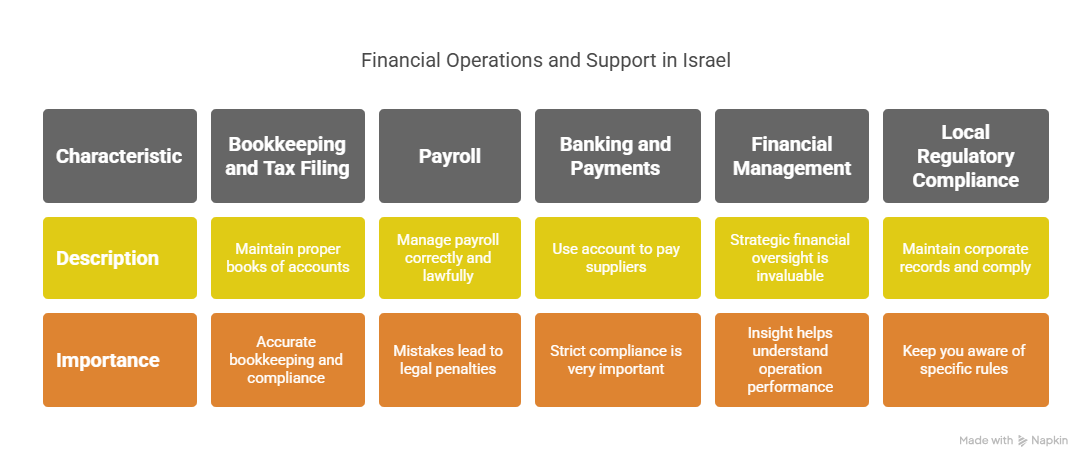

Financial Operations and Support for Your Israeli Entity

Setting up the legal entity is only the beginning. Running a business in Israel comes with ongoing financial and operational tasks that foreign companies must handle properly to remain compliant and financially efficient. Key areas to consider include:

Bookkeeping and Tax Filing:

Israel, like all countries, requires that companies maintain proper books of accounts and use approved accounting software. You’ll need to record all transactions in accordance with Israeli accounting standards, issue invoices with proper VAT, and keep records for audits. Regular tax filings are mandatory – this includes monthly/bi-monthly VAT reports, monthly payroll tax submissions, and annual corporate tax returns.

Keeping up with these requirements can be complex, especially with frequent changes in regulations. It’s vital to have knowledgeable staff or partners who understand local accounting rules. According to BDO Israel, running an active business in Israel requires adequate bookkeeping systems, compliance processes, and timely tax filings.

Missing a filing or misreporting taxes can result in fines or other sanctions, so accurate bookkeeping and compliance oversight are critical.

Payroll:

If you hire employees in Israel (even a small team of developers or sales reps), managing payroll correctly is crucial. Israel has intricate labor laws, mandatory pension contributions, severance pay accruals, vacation/sick day requirements, and social security (National Insurance) payments that must be calculated and remitted. Payroll processing in Israel requires extensive knowledge of local labor and tax laws.

For example, employers must withhold income tax and social contributions from salaries, pay employer’s National Insurance contributions, and deposit pension funds on behalf of employees. There are also reporting obligations to the authorities and providing payslips in Hebrew with specific details. Mistakes in payroll can not only upset employees but also lead to legal penalties.

Engaging a professional payroll service ensures all calculations are correct and lawful, and that someone is handling the monthly interactions with pension funds, tax authorities, and so on.

Banking and Payments:

As mentioned, Israeli banks can be strict with compliance. Once your account is open, you’ll likely use it to pay local suppliers, employees, and receive any local revenue. International companies often need multi-currency capabilities (Israeli accounts can be multi-currency, e.g. holding ILS, USD, EUR).

It’s important to reconcile bank statements with your books and manage currency exchanges if needed. Also, consider who will have signing authority on the account – often you may authorize a local manager or an outsourced CFO to co-sign payments for convenience.

Financial Management (CFO/Controller Services):

Beyond day-to-day bookkeeping, having strategic financial oversight is invaluable. A seasoned financial controller or CFO who is familiar with Israeli practices can produce management reports, ensure that your Israeli entity’s finances are aligned with your global corporate standards, and advise on budgeting, cash flow, and tax optimization.

BDO notes that an outsourced team can act as the local financial management team for global clients, liaising with your headquarters and providing comprehensive financial reporting (monthly closes, tailored reports, etc.).

This kind of insight helps you understand how your Israeli operation is performing and ensures transparency and control over the new entity’s finances.

Local Regulatory Compliance: Israel has various other regulations – for instance, companies need to maintain certain corporate records, hold annual general meetings (even if on paper for a single shareholder), and comply with any industry-specific laws if applicable (data protection, import/export regulations, etc.).

Having local experts advise you will keep you aware of any Israel-specific rules that a foreign company might not be immediately familiar with. Additionally, if operating as a foreign company branch, remember you must have an appointed local representative for tax purposes who can submit reports and be accountable for the branch’s tax obligations.

Even for subsidiaries, if all directors are abroad, you might need a local point of contact. Consider appointing a trusted local director or using nominee director services if necessary to handle any on-the-ground requirements.

How ERB Can Support Your Israeli Expansion

Navigating all these requirements may seem daunting, especially if your core team is not based in Israel. This is where outsourced financial and operational services become incredibly valuable. Rather than building a full in-house finance department in Israel on day one, many foreign companies partner with firms like ERB to handle these functions professionally and cost-effectively. ERB (with offices in Tel Aviv, London, New York, and California) is a leading provider of outsourced financial services, specializing in helping startups and international companies manage their finances across borders.

Founded in Tel Aviv nearly 30 years ago, ERB has deep experience guiding companies from the inception and entity setup stage all the way through global growth.

In fact, ERB has been a pioneer in outsourced CFO services in Israel, providing comprehensive support to companies for over 27 years.

This means when you work with ERB, you gain access to a seasoned team of CFOs, controllers, bookkeepers, and payroll specialists who are well-versed in Israeli regulations and business practices. Here are some key ways ERB’s outsourced financial services can support your Israeli entity:

1. Entity Setup and Registration:

ERB assists foreign companies with the initial setup process in Israel. From preparing incorporation documents, coordinating with legal advisors, to registering with the authorities, ERB can project-manage the entire formation process. According to BDO (a Big-5 firm), having local experts assist with opening the necessary files, appointing VAT representatives, and ensuring compliance from day one is invaluable for a smooth launch.

ERB provides similar support, acting as your liaison on the ground to handle bureaucracy so you can focus on planning your business.

2. Bookkeeping and Accounting:

Once your subsidiary is up and running, ERB’s accounting team will take care of bookkeeping, financial record-keeping, and compliance filings. This includes setting up an approved accounting system, recording all transactions in the required format, and preparing monthly and annual statements. They will handle monthly VAT filings, annual tax returns, and any other required financial reports on your behalf.

By outsourcing these tasks, you ensure that nothing falls through the cracks – reports are filed on time and in full compliance with Israeli law, avoiding penalties and keeping your company in good standing. As an added benefit, outsourcing can be cost-effective and efficient. It provides you a full finance capability without the cost of hiring multiple full-time staff. BDO Israel notes that outsourcing financial operations is a cost-effective way to establish a new business in Israel while ensuring compliance with local laws and tax requirements- this reflects the value that ERB delivers through its services.

3. Payroll Services:

ERB offers comprehensive payroll processing in Israel, ensuring your employees are paid accurately and on time, and that all withholdings and contributions are handled properly. Given that payroll in Israel requires knowledge of local labor law, tax, and social security regulations, having ERB manage this function shields you from the complexity. They will calculate salaries, income tax withholdings, national insurance, pension contributions, and any other benefits. They also take care of payslip generation (in compliance with Israeli law) and liaise with relevant institutions (e.g. transferring pension payments, reporting to tax authorities). This outsourced solution means you can onboard employees confidently, knowing that a local expert is administering your Israeli payroll with full compliance.

4. CFO and Financial Management:

One of the standout offerings of ERB is its outsourced CFO and controllership services. When you’re a growing company entering a new market, you often cannot justify a full-time senior finance executive in each location. ERB solves this by providing fractional CFO services – you get high-level financial oversight and strategic guidance on an as-needed basis. Industry observers have noted that outsourced CFO services give companies access to seasoned financial leadership at a fraction of the cost of a full-time hire, with flexibility to scale as the business grows.

5. Through ERB, you’ll have experienced CFOs and controllers:

who can help with budgeting and financial planning, implement financial controls, ensure your Israeli operation’s finances align with your global reports, and produce insightful management reports. Essentially, ERB can act as your local finance department in Israel.

They provide 360° support – from daily accounting to strategic financial advice – functioning as a powerful ally to drive your business forward.

This ensures you have clear visibility into your Israeli subsidiary’s performance and expert advice on financial decisions, without needing to build a full finance team from scratch.

6. Banking and Payments Support:

With ERB’s team on board, tasks like bank account setup and management become much easier. They have experience working with Israeli banks and can guide you through compliance questions or documentation requests. Post setup, ERB can help manage payments to vendors and employees, perform bank reconciliations, and monitor cash flow. If your parent company needs to fund the Israeli subsidiary, ERB can assist in planning intercompany funding and documenting it correctly (which can have tax implications). They essentially ensure that the financial operations – from bank dealings to routine transactions – run smoothly in-country.

7. Regulatory Compliance and Advisory:

Beyond the day-to-day, ERB stays up to date on changes in Israeli financial regulations, tax laws, and reporting standards. They will advise you on any new requirements (for example, updates in tax rates, new labor laws affecting payroll, or additional filings that might be introduced). Compliance is not just about avoiding penalties – it also builds your company’s reputation as a responsible operator in Israel. With ERB’s proactive guidance, you won’t be caught off-guard by regulatory surprises. For foreign companies, having a partner who can ensure compliance with local law and tax requirements from day one is a major relief.

In short, ERB provides a one-stop-shop solution for foreign companies establishing operations in Israel. Their services cover the full spectrum of financial and operational support: outsourced CFO, controllership, bookkeeping, tax compliance, payroll, and more.

This comprehensive approach means you can entrust all financial management aspects to a single experienced team. As ERB’s own philosophy states, they tailor their services to each company’s needs and stage – from the first stage of establishment, building the financial foundations, to ongoing management of all accounting, taxation, and operational finance needs.

Focus on Your Business, Let ERB Handle the Rest

Entering a new market like Israel is an exciting step for any company. It opens doors to innovation, top talent, and new business opportunities. By taking care to set up your Israeli entity properly and investing in the right local support, you set the stage for success.

Many companies that expanded to Israel have thrived, especially when they leveraged local expertise to navigate the initial setup and ongoing compliance. Rather than getting bogged down in paperwork, regulations, and financial administration, partnering with an experienced firm like ERB allows you to focus on your core business.

You get the peace of mind that professionals are managing your Israeli entity’s finances in line with best practices and local law. This not only ensures compliance (avoiding costly mistakes), but also provides strategic financial insight to help your venture grow. In conclusion, establishing an Israeli entity can be straightforward with the right guidance.

The process – from choosing the structure, registering the company, opening bank and tax files, to running payroll and accounts – has been successfully done by many foreign firms. With ERB’s outsourced financial services by your side, you gain a trusted partner to handle these challenges. They bring decades of experience and a proven track record in supporting companies just like yours expanding into Israel.

Whether you are a U.S. tech startup setting up an R&D center in Tel Aviv, or a UK company launching operations in Israel, ERB’s team stands ready to ensure your Israeli entity is not only established smoothly but also managed professionally thereafter.

Embarking on an Israeli expansion? With expert support in accounting, payroll, CFO services, and financial compliance, you can hit the ground running.

ERB will take care of the operational and financial groundwork – empowering you to capitalize on Israel’s opportunities and drive your business forward, confidently and compliantly.